Table of Contents

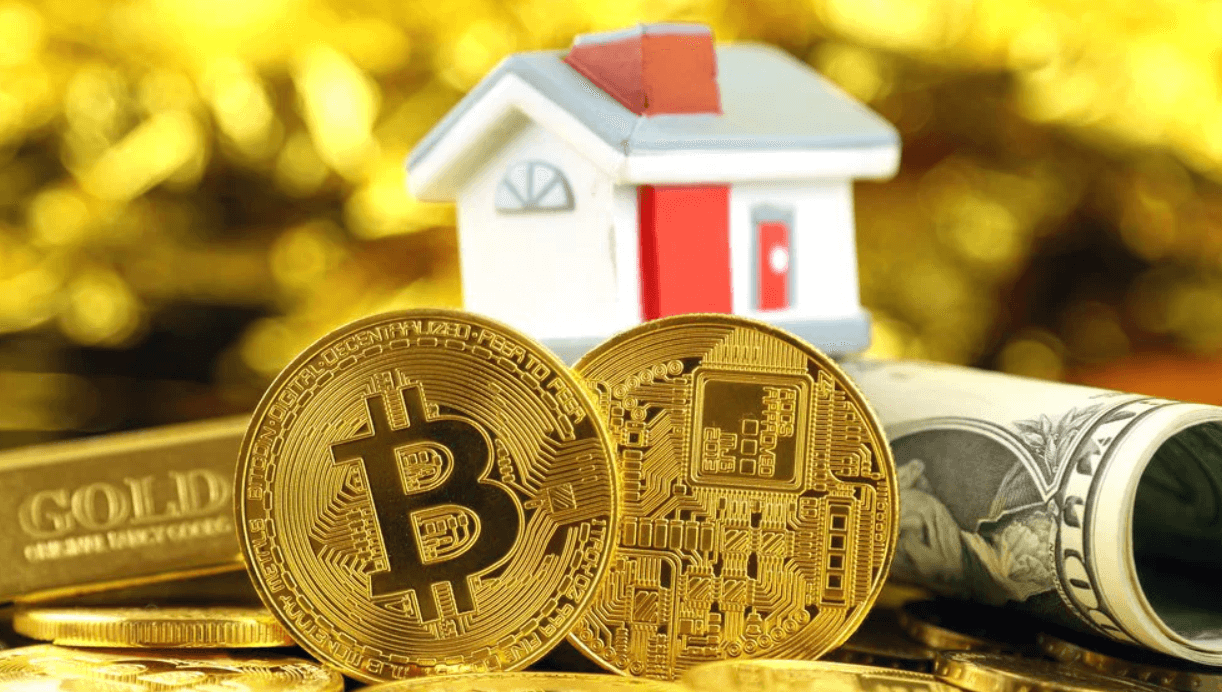

The real estate industry, recognized for its traditional and often slow-paced nature, has undergone a notable transformation in recent years, thanks to the rise of cryptocurrencies. Bitcoin, a trailblazer in the realm of digital currencies, has significantly influenced the integration of blockchain technology into real estate transactions. This article takes a closer look at real estate cryptocurrencies. There are many more concepts and things to know about the market! Explore this site Immediate Vortex, as it is a modern-day education platform that connects you with exports seamlessly.

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that utilize cryptography for security. They operate on decentralized blockchain technology, ensuring transparency and immutability of transactions. Blockchain, a distributed ledger, plays a crucial role in revolutionizing real estate by enhancing transparency, reducing fraud, and streamlining processes.

The Intersection of Real Estate and Cryptocurrencies

Tokenization of Real Estate Assets

Tokenization refers to the process of representing real-world assets, such as real estate properties, as digital tokens on a blockchain. This allows for the fractional ownership of high-value assets, making real estate more accessible to a broader range of investors. Benefits include increased liquidity, reduced barriers to entry, and improved transparency.

Use Cases of Cryptocurrencies in Real Estate

Property Transactions Using Cryptocurrencies: Cryptocurrencies can be used to facilitate property transactions. This eliminates the need for intermediaries like banks and reduces transaction costs and processing time.

Real Estate Investment Opportunities: Investors can purchase tokens representing real estate assets, allowing them to invest in high-value properties with smaller capital.

Crowdfunding and Decentralized Finance (DeFi): Cryptocurrencies enable crowdfunding platforms that pool funds from multiple investors to purchase properties collectively. DeFi platforms provide financial services without traditional intermediaries.

Bitcoin’s Influence on Real Estate

Early Bitcoin Real Estate Transactions

In the early days of Bitcoin, pioneers explored its use in real estate transactions. Notable cases include a Florida property sale for 17.7 BTC in 2017 and a Manhattan apartment listing priced at 25 BTC in 2018. These transactions demonstrated the feasibility of Bitcoin as a medium of exchange for real estate.

Current Trends in Bitcoin and Real Estate

Bitcoin as a Store of Value: Bitcoin’s increasing adoption as a store of value has led real estate investors to consider it as an alternative asset class for diversifying their portfolios.

Cryptocurrency-Friendly Real Estate Developments: Some real estate developers now accept cryptocurrencies as payment for property purchases, fostering a cryptocurrency-friendly ecosystem.

Challenges and Concerns

Regulatory Hurdles in Real Estate Cryptocurrencies

The regulatory landscape for real estate cryptocurrencies is evolving. Different jurisdictions have varying rules and interpretations regarding their use, leading to legal complexities.

Security and Fraud Risks

While blockchain enhances security, it’s not entirely immune to threats. Smart contract vulnerabilities and phishing scams can result in financial losses if not adequately addressed.

Price Volatility and Its Impact on Real Estate Investments

Cryptocurrency markets are known for their price volatility. Real estate investors must consider this when using cryptocurrencies for transactions or investments.

Legal Implications and Taxation

Taxation and legal aspects related to cryptocurrency transactions in real estate need to be carefully managed to avoid legal disputes and compliance issues.

Promising Real Estate Cryptocurrencies

Beyond Bitcoin: Altcoins and Real Estate

Ethereum and Smart Contracts in Real Estate: Ethereum’s smart contract capabilities enable automated and self-executing real estate transactions, reducing the need for intermediaries.

NFTs (Non-Fungible Tokens) in Property Ownership: NFTs can represent unique property ownership, making it easier to transfer and trade ownership rights.

Real-World Projects and Their Success Stories

Several real estate projects, such as Propy and RealT, have successfully leveraged blockchain and cryptocurrencies to streamline real estate transactions and investments.

Future Prospects

Predictions for the Growth of Real Estate Cryptocurrencies

Experts predict continued growth in the use of cryptocurrencies for real estate transactions, with more properties tokenized and a broader range of investors participating.

Potential Collaborations and Partnerships

Collaborations between blockchain companies, real estate firms, and financial institutions can drive innovation and create a more robust ecosystem for real estate cryptocurrencies.

The Role of Governments and Regulatory Bodies

Government and regulatory support and clarity can provide a stable and secure environment for the adoption of cryptocurrencies in real estate.

Evolving Technology and Its Impact

As blockchain and cryptocurrency technology continue to evolve, new features and solutions may emerge to address current challenges and further streamline real estate processes.

Conclusion

In conclusion, Bitcoin’s legacy in the realm of real estate cryptocurrencies is undeniable. Its role as a pioneer has paved the way for innovative solutions that have the potential to reshape the real estate industry. However, challenges such as regulatory hurdles and security concerns must be addressed to fully harness the benefits of this evolving intersection of technology and real estate. As the industry continues to evolve, investors, developers, and regulators need to stay informed and adapt to this new digital landscape.

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1-150x150.png)

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 7 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1.png)