Table of Contents

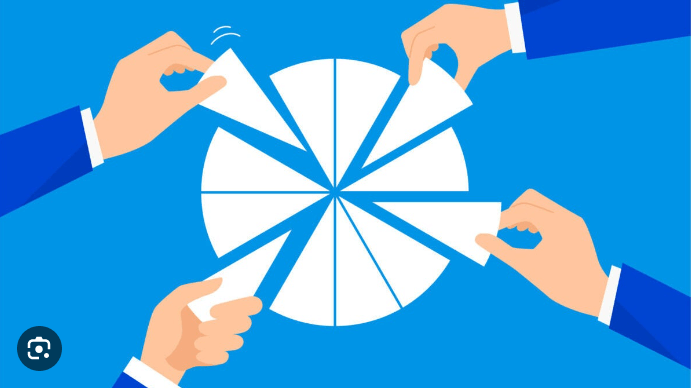

Mutual funds are investment vehicles that gather money from a number of investors to invest in diverse stocks, bonds, or other securities.

Mutual funds provide an easy way for stock investing beginners to have access to diversified portfolios controlled by skilled fund managers. However, not all mutual funds have the same features.

In this article, we will explore essential tips and strategies to help beginners pick the best mutual funds tailored to their needs and objectives.

Picking the Best Mutual Funds

There are several important factors to consider when trying to pick the best possible mutual funds.

1. Investment Goals

Mutual fund investment objectives are the financial targets you want to reach by investing in mutual funds.

These can be short-term, like saving for a holiday, mid-term such as saving for the purchase of a house, or long-term goals, like retirement savings and educational expenses for children.

The goal of investing will determine the type of mutual funds that you invest in because different mutual funds are created to achieve different goals.

2. Risk Tolerance

Risk tolerance is the ability and willingness to lose some or all of your initial investments in return for higher returns.

An aggressive investor, often with a longer time horizon, might be at ease with equity mutual funds that are prone to market swings and may potentially provide better results.

On the other hand, a conservative investor who usually has a shorter time period may go for mutual debt funds, which, on the other hand, are more stable and have fixed returns but of a lesser value.

3. Liquidity

Liquidity is yet another factor that should be considered. Liquidity refers to the speed at which an investment can be turned into cash.

Concerning mutual funds, it’s about the date you think you could use your capital. If you anticipate needing to have the money in a short while, then owning equity mutual funds might not be advisable.

They are exposed to market movements, and their value may go down for a while. As such, pulling out prematurely may lead to an unanticipated return.

4. Expense Ratio

The expense ratio is like a fee that investors pay to the fund manager for managing their investments. It’s the cost of running the mutual fund. It’s important to choose funds with lower expense ratios because even though the percentage might seem small, it can add up and eat into your overall investment returns over time.

The expense ratio depends on the size of the fund’s Assets Under Management (AUM). Generally, funds with higher AUM tend to have lower expense ratios.

So, aiming for funds with lower expense ratios can help you save money and potentially increase your investment profits.

5. Past Performance

Past performance refers to the historical returns of a mutual fund. It shows how the fund has performed over a certain period of time in the past. This can give you an idea of the fund’s volatility and consistency.

However, the past performance is not indicative of future results. Market conditions change, and a fund that has performed well in the past may not necessarily do so in the future.

Therefore, while past performance can be a useful piece of information, it should not be the sole basis for investment decisions.

Also Read: 4 Marketing KPIs Your Company Should Be Measuring

Conclusion

Choosing the right mutual funds is super important for beginners in stock investing. By knowing what they want to achieve with their money, checking how well the funds have done in the past, watching out for fees, and spreading their investments around, beginners can make smart choices.

With some research and help, beginners can feel more confident and do better with their investments in mutual funds.