Table of Contents

JC Penney is one of the most popular U.S. department stores, and they offer a variety of credit cards to their customers. A credit card approval score is an important factor in determining whether or not someone will be approved for a credit card. According to WalletHub, the average JCPenney credit card approval score is 684. This means that only about 7% of applicants are approved for a JCPenney credit card.

While the low approval rate may be frustrating, it’s important to keep in mind that this doesn’t mean you shouldn’t apply for a JCPenney credit card – just be prepared to wait a while if you do. The high APR (above 29%) and low rewards (just 1% on rotating categories) are also factors to consider before applying.

What exactly is JCPenny credit card approval score?

The JCPenney credit card approval score is a score that measures an individual’s creditworthiness. This score helps lenders determine if an individual is likely to repay their debts and keep up with payments on time.

A good credit score can help individuals qualify for better loan terms, including lower interest rates and higher spending limits. The exact requirements vary based on the lender, but generally speaking, a good credit score may range from 700 to 850.

A lower score may indicate that an individual is more likely to be delinquent on payments or default on their loan.

It’s important to note that not all lenders use the same credit scoring methodology when making decisions about loans, so it’s important to check with the specific lender you want to apply for a loan with.

In order to qualify for a JCPenney credit card, applicants must have an average credit score of at least 600. It’s important to note that this is only an average and some lenders may require a higher or lower score depending on the individual’s financial history.

Individuals with a low credit score may still be able to qualify for the JCPenney card, but they may have to pay higher interest rates or deposit more money into an account as collateral.

How to get JCPenney credit card approval score: The basics

If you’re looking to get approved for a JCPenney credit card, here are some tips to help you stand out from the crowd. Firstly, make sure that your credit score is good. This may seem like an obvious thing to say, but many people don’t realize that having an amazing credit score is essential for getting approved for a JCPenney credit card.

Another important factor is your payment history. If you’ve been timely with all of your payments in the past, this will show up on your credit report & help you improve your approval rating. Finally, be sure to provide accurate information when applying for a JCPenney credit card approval score– including your current income and spending habits.

How to use your JCPenney credit card: Tips and advice

If you’re looking to use your JCPenney credit card, there are a few things to keep in mind. First, make sure you have the right credit score to qualify. Second, be aware of the card’s processing fees.

To see if you have an amazing credit score, JCPenney recommends checking with either Experian or Equifax. If your score is lower than 620 on a scale of 300-850, you may not be able to qualify for a JCPenney credit card without improving your credit history.

To avoid processing fees, make sure all of your information is accurate when applying for the card.

The rewards program: What are the benefits of signing up?

JC Penney is one of the most popular retailers in the United States. The company has over 2,000 stores across the country. In order to make a purchase at one of these stores, customers must first have a JC Penney credit card.

One of the benefits of having a JC Penney credit card is that customers can take advantage of the company’s rewards program. The rewards program offers discounts on items in the store and online. Additionally, customers can earn points that can be redeemed for cash or gift cards. Customers with a good credit score are likely to receive better rewards than those with a poor credit score.

Those who are not eligible for a JC Penney credit card may still be able to take advantage of the company’s rewards program through partner programs. These partner programs allow customers to earn rewards based on their spending habits.

What factors influence JCPenney’s credit card approval score?

JC Penney has long been known for its affordable clothing and accessories. To get approved for a credit card with the retailer, applicants must have a good credit score and meet other eligibility requirements.

Some factors that may influence JC Penney’s credit card approval score include the applicant’s history of borrowing money, the applicant’s current debt-to-income ratio, and whether or not the applicant has ever been late on a payment.

In order to improve their credit score, applicants are encouraged to pay their bills on time and maintain a low debt-to-income ratio. Additionally, applicants should make sure they have strong financial credentials such as a steady income and no history of bankruptcy.

How does JCPenney’s credit card approval score compare to other retailers?

JC Penney has an approval score of 720, making it one of the better-performing credit card issuers. This is in comparison to retailers like Macy’s (650) and Sears (667), which have approval scores that are lower than JCPenney’s despite carrying a higher total debt load. In fact, Sears’ overall approval score is only two points higher than JCPenney’s despite carrying almost twice as much debt.

One reason for JCPenney’s high credit card approval score may be its focus on customer service. The company has been awarded five stars by the Better Business Bureau for every category of service, including billing and collections. Additionally, JCPenney offers a rewards program that encourages customers to use their cards regularly.

What are the benefits of using a JCPenney credit card?

JCPenney credit cards offer many benefits to cardholders, including a high approval score. Credit card companies use a variety of factors when evaluating applicants for credit cards, but the approval score is one of the most important factors. The higher your approval score, the more likely you are to be approved for a credit card.

Use JCPenney credit cards to improve your credit history and build your credit credibility. There are several types of JCPenney credit cards, so find the one that best suits your needs. You can use your JCPenney credit card to purchase items in-store and online, so choose the right card for you and enjoy the benefits today!

Also Read This: Credit Card Generator | Top10 credit card generators that work

What are the risks associated with using a JCPenney credit card?

JCPenney is the largest department stores in the United States. The company offers a variety of credit cards to its customers. Some of the risks associated with using a JCPenney credit card are:

-The approval score for a JCPenney credit card can vary significantly depending on the individual’s credit history. Someone with no credit history may be approved for a low-limit card, while someone with a good credit history may be approved for a high-limit card.

-If you miss payments on your JCPenney credit card, your approval score could be affected.

Conclusion: Is a JCPenney credit card worth applying for?

JCPenney is a well-known retailer that sells everything from clothes to home decor. The company offers credit cards, which can be beneficial for customers who want to build a credit history and potentially qualify for loans in the future. However, before applying for a JCPenney credit card, it’s important to understand the approval process and how your credit score may affect your potential acceptance.

Typically, JCPenney will approve applicants with a good or excellent credit score. However, there are certain circumstances where an applicant may not be approved, such as if the applicant has had negative experiences with debt consolidation or debt settlement in the past. In addition, if you have high levels of debt from other sources (such as student loan debt), your JCPenney credit card approval score application might be rejected.

FAQs

Q: What is the minimum credit score required to be approved for a JCPenney credit card?

A: The minimum credit score required for approval of a JCPenney credit card is not publicly disclosed by the company. However, the credit card issuer, Synchrony Bank, generally looks for applicants with good to excellent credit scores (700 and above).

Q: What are the benefits of having a JCPenney credit card?

A: Some benefits of having a JCPenney credit card include exclusive discounts and promotions, special financing options, and rewards points that can be redeemed for future purchases.

Q: Can I apply for a JCPenney credit card online?

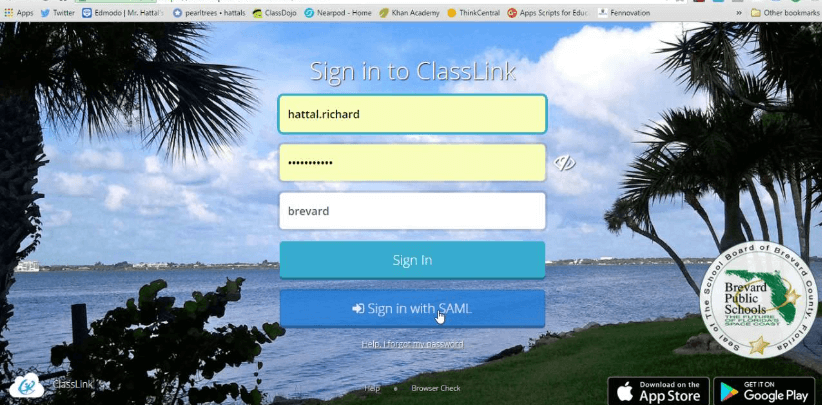

A: Yes, you can apply for a JCPenney credit card online through the company’s website or through the Synchrony Bank website.

Q: How can I check the status of my JCPenney credit card application?

A: You can check the status of your JCPenney credit card application by calling the Synchrony Bank customer service line or by logging into your account on the Synchrony Bank website.

Q: Can I use my JCPenney credit card at other stores?

A: The JCPenney credit card can only be used at JCPenney stores and on the company’s website.

Q: Are there any fees associated with the JCPenney credit card?

A: There may be fees associated with the JCPenney credit card, such as annual fees, late payment fees, and over-the-limit fees. Be sure to review the terms and conditions of the card before applying.

Q: How can I make payments on my JCPenney credit card?

A: You can make payments on your JCPenney credit card by mail, online, or by phone. You can also set up automatic payments through your online account.