Table of Contents

In an era where the promptness and accuracy of financial transactions underscore a company’s reliability, diligent payroll management is more than a necessity—it’s a strategic asset. Whether you’re a burgeoning start-up or an established enterprise, how you handle payroll can significantly influence employee satisfaction and your business’s legal compliance.

Now, let’s delve deeper into the essentials of modern payroll management and how it can be harnessed to streamline operations within any organization. A comprehensive understanding of these practices is crucial for any business aiming to optimize its payroll functions.

Key Takeaways:

- Understanding the basic components and challenges of payroll management is essential.

- Regulatory compliance is a critical aspect that affects payroll processes.

- Technological advancements and integration with HR systems contribute to more efficient payroll management.

- Securing payroll data is paramount in protecting sensitive employee information.

- Staying informed on future trends can help prepare your business for upcoming changes in payroll management.

Understanding Payroll Fundamentals

The keystone of payroll management is understanding its core components: payment calculations, tax withholdings, compliance with labor laws, and the disbursal of employee compensation. A well-organized payroll system enables employers to navigate the complex landscape of financial responsibilities effectively. Challenges often surface in the form of ever-evolving tax laws, varying benefit packages, and the consolidation of time and attendance data, all of which demand meticulous record-keeping and a robust processing system.

The Impact of Regulatory Compliance on Payroll

Businesses must keep pace with the regulatory environment that governs payroll processing. Compliance entails abiding by wage and hour laws, tax codes, and numerous other requirements that can be labyrinthine. For example, the application of garnishments, such as child support orders, must be precisely calculated and implemented. Resources like Employer Responsibilities in Payroll Taxes: How to Stay Compliant, provided by the IRS, serve as indispensable guides for employers to avoid missteps that could lead to significant financial penalties.

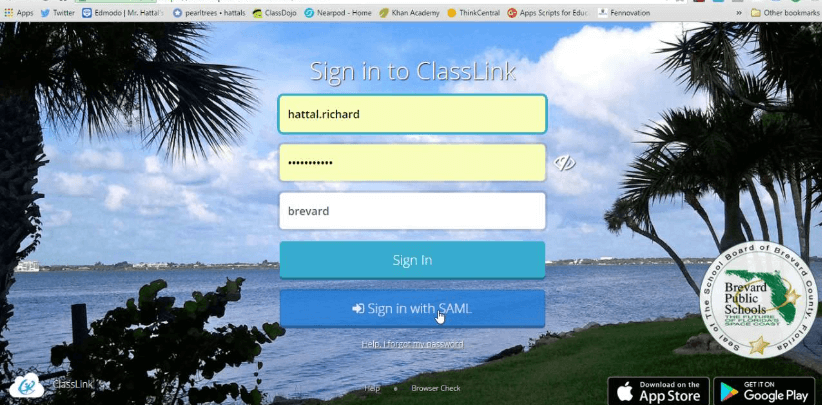

Advancements in Payroll Technology

Technology has been a powerful driver of change in payroll management. The digitization of systems has facilitated the automation of payroll tasks, dramatically reducing the time required to process payments. Advances in cloud-based platforms offer businesses scalable solutions that can be accessed remotely, providing a seamless experience for employees and employers. These high-tech systems streamline operations and provide insightful analytics, enabling better financial planning and strategy.

Integrating Payroll with Human Resource Management

Streamlining payroll with human resource management systems is a strategic approach with numerous benefits. A unified approach in which HR and payroll data coexist can enhance data integrity, reduce administrative costs, and eliminate duplicated efforts. For employees, it simplifies processes such as accessing payslips, updating personal information, and tracking leave balances, fostering a more transparent and satisfying workplace environment.

Best Practices for Processing Payroll Efficiently

Payroll efficiency is not simply a matter of speed—it’s about developing a reliable and error-free system. Critical practices for achieving this include thorough training for payroll staff, employing automated reminders for critical deadlines, and regular reconciliation processes to spot discrepancies swiftly. With these practices in place, businesses can confidently deliver on their payment obligations and maintain high employee trust.

Payroll Management for Remote Workers

The rise of remote work presents new challenges for payroll departments, particularly regarding taxation in different jurisdictions. Employers must stay current with tax laws in their remote employees’ states or countries. Furthermore, they should invest in robust payroll solutions that efficiently handle varying time zones, currencies, and regulatory requirements, ensuring a seamless payroll experience for the distributed workforce.

Data Security in Payroll Systems

Given the sensitive nature of payroll data, which includes personal, banking, and compensation details, protective measures to safeguard such information cannot be overstated. Strengthening cybersecurity protocols, implementing regular security audits, and providing comprehensive training on data handling are vital steps in shielding against breaches. Moreover, staying updated with the latest security technologies can reinforce an organization’s defenses against potential cyber-attacks.

Outsourcing vs. In-house Payroll Processing

Choosing between outsourcing payroll functions and managing them in-house is a pivotal decision for businesses. It is influenced by several factors, including the expertise available within the organization, cost considerations, the need for control over payroll processes, and the capacity to keep up-to-date with compliance requirements. A meticulous evaluation of these aspects will guide businesses toward the most advantageous and efficient payroll management model for their unique situation.

Future Trends in Payroll Management

The future landscape of payroll is poised for a transformation driven by technological innovations. Artificial intelligence and machine learning stand to revolutionize payroll processes, offering predictive insights and automating routine tasks. Moreover, the adoption of blockchain technology promises to enhance transparency and security. Industry professionals should take cues from foresightful sources such as The Future of Payroll: How Technology is Shaping Modern Payroll Systems to stay ahead of the curve.

Final Thoughts on Maximizing Payroll Efficiency

Throughout this exploration, it becomes evident that harmonizing technology, steadfast adherence to compliance, and informed adoption of best practices are the cornerstones of a proficient payroll system. Businesses that rigorously appraise and continuously refine their payroll practices are the ones that will navigate the future of workforce management with relentless efficiency and integrity.