Table of Contents

For those that use it, modern payroll software is essential because incorrectly paid or late paid employees will lose faith in the company. The software can pay for itself when used to its fullest extent. Here are 4 reasons why modern payroll software is essential for businesses.

1. Cut Out Needless Errors

Making mistakes is something that humans are well accustomed to. Having a bad day or being overly tired can lead to greater inaccuracies.

While errors on a Word document or presentation might be something that can be hastily corrected before sharing the document or leading the presentation, that’s not the case with payroll. Given that the IRS collects billions annually in penalties for errors in business employment taxes, mistakes with miscalculations, incorrect form completion, or omissions can cost dearly.

Using a dependable payroll solution reduces the likelihood of making an error to close to nil. Effective software can pick up on frequent mistakes and catch them before they become finalized. The automatic calculation of financial figures based on the latest relevant state and federal tax laws also avoids outdated tax knowledge causing unforeseen errors.

Must Read:6 New Software You Didn’t Know You Needed

2. Finally Access Payroll from Anywhere

If you’ve previously been used to desktop versions of payroll packages, then this can begin to feel a little restrictive.

With this software type, it’s only accessible from the PC that it’s been installed on due to a limiting software license. Therefore, if someone else is using that computer at the time, you’re stuck. Also, if it’s down for repair, the same applies.

A payroll SaaS solves this problem by being cloud-based. As a result, it’ll run through any compatible web browser, such as Chrome or Safari. It’s cross-platform too because a browser is needed to use it. This also applies to mobile users where a review of payroll information on the go is made possible.

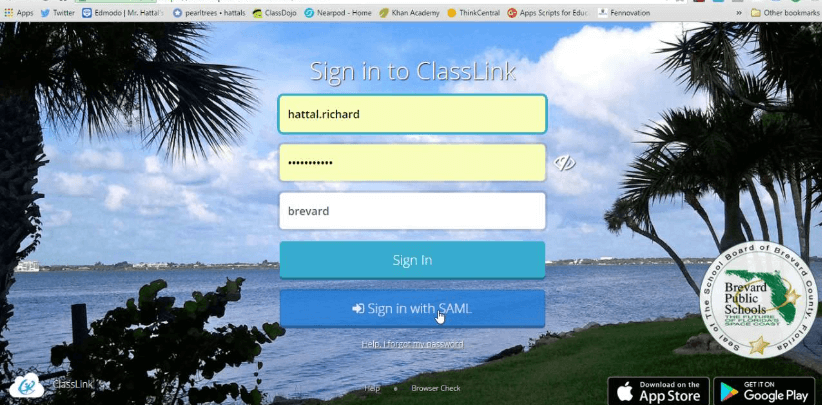

3. Employees Can Review Online Paystubs

Paystubs can be mislaid by employees, which can make tax season tougher on them.

A state-of-the-art payroll system should allow all employees to access their paystubs online via a secure login. Rather than leafing through multiple crumpled paper-based paystubs, the information can be seen for all pay periods and made searchable too.

Furthermore, benefits and deductions can include supporting information to better understand each paystub. This reduces the number of queries from employees because they’re unclear about the latest garnishments or tips reporting.

Must Read: How to negotiate for a higher salary?

4. Prevent Payment Delays

A significant percentage of employees live paycheck-to-paycheck despite an outside appearance that suggests greater affluence.

Any delay in making payroll payments due to complications with calculations meeting regulatory requirements can inconvenience employees. If it lasts a few days, some employees will see automated payments bounce due to insufficient funds or have difficulty covering essentials.

Such is how tight money is for many employees with major obligations including family commitments or other concerns. Using payroll software updated to produce efficient payroll calculations in less time meets a clear need.

If you’re trying to make do with inferior software that’s not fit for the task, find better payroll software that is. It’s simply not worth waiting until problems have already occurred before doing so.