Leasing a vehicle can be a great way to test out a new car before committing to purchase it. Whenever you reach the end of your lease, you can extend the lease, purchase the car, or give it back. If you like the vehicle and want to buy it, you’ll need to get a car lease buyout loan.

How Does a Lease Buyout Loan Work?

A lease buyout loan works by providing you with cash to purchase a leased vehicle. When you first sign the paperwork for your lease, it should have a residual value listed.

This is the value that you can purchase the vehicle for at the end of your lease agreement. Be sure to also add in fees for the title and taxes that go along with the vehicle purchase.

Must Read: 10 of the Largest Car Insurance Companies in the US

Three Things to Consider With a Lease Buyout Loan

It’s crucial to note that not all lenders will offer lease buyout loans. You’ll want to check ahead of time to determine which lenders provide this type of loan.

This holds especially true if you’re looking for auto refinance with bad credit. Having poor credit could throw a wrench into your plans of getting approved for a lease buyout loan.

You must fully understand the current market value of your vehicle before committing to a lease buyout loan. Using an online tool like KBB or Edmunds can give you this value.

If you determine that the current market value of your vehicle is much less than the residual purchase price in your lease agreement, you can purchase your leased car with equity.

It’s also important to note that lenders will look at leased cars the same as they do used cars. This means that to secure financing, you’re likely looking at a higher interest rate for your vehicle.

Must Read: 5 Of the Most Iconic All-Terrain Vehicle Families

How to Get a Lease Buyout Loan

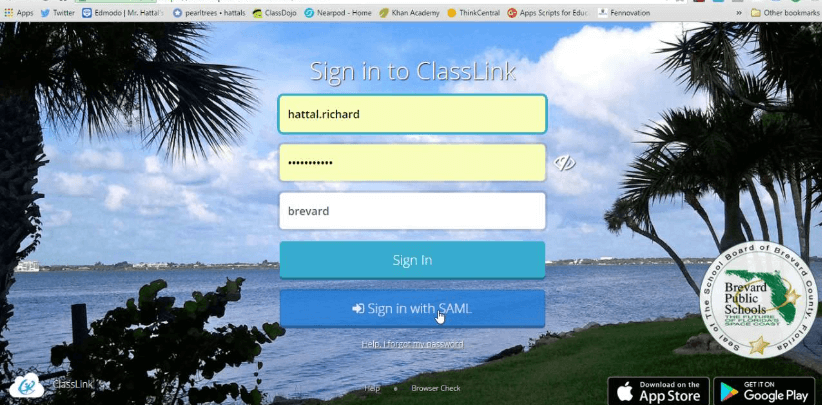

If you’re interested in obtaining a lease buyout loan, it’s a good idea to get in touch with your leasing company. Let them know that you intend to purchase the vehicle and verify the residual value so that you’re attempting to get a loan for the right amount.

Next, take the time to shop around to determine which lenders offer car lease buyouts. You’ll want to assess the various APRs that are available to you and term lengths.

According to Lantern by SoFi, “Pay close attention to loan terms, which can vary greatly, depending on the lender. The longer the loan term, the lower the monthly payments will be, but that means more interest will be paid over the life of the loan.”

Must Read:Complete Guide to Read Before Buying A Sports Car

Once you determine which lender has the ideal terms for your car lease buyout loan, it’s time to apply. You’ll need to submit various documents to verify your income and credit history. Once approved, they will finalize your paperwork, pay off the original lender, and transfer the title.

If you’re thinking about investing in your leased vehicle at the end of your lease agreement, you’ll want to utilize the information above to obtain a car lease buyout that fits your budget.