Table of Contents

Whether you rent your own, or you have a homeowner loan, you are going to need suitable home insurance. Home insurance that protects you and your home from accidents, and from thefts, is crucial. Policies can vary in coverage, price, and quality. So, how can you be sure you are choosing the best policy for you and your home?

Check Out the Coverage

Whether you own a condo or a suburban detached home, you will want to make sure that you are suitably covered with your home insurance policy. You may find that insurance policies look good to begin with, but that they end up having a lot of exclusions and permutations which you do not need or want.

Thinking carefully about what coverage you need, and then narrowing down your search criteria to suit is going to be crucial to your search. If you are not getting the correct coverage, you may not get the full protection you require with your insurance products.

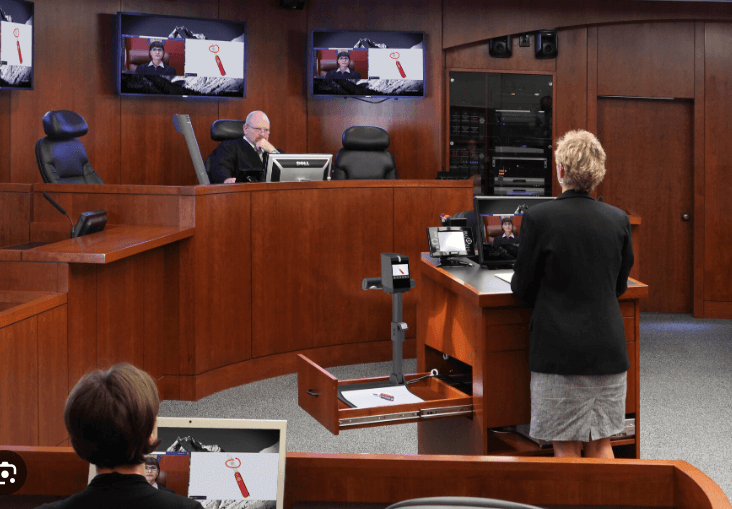

Consider using a Broker

You can spend a lot of time searching for deals and looking at individual insurance providers. After a few hours of searching the market, you can get overwhelmed by the choices available to you. This can mean that you end up potentially overpaying or even missing out on the best deal possible.

Using an insurance broker like kbdinsurance.com can give you the convenience you need, and save you time and energy too. Insurance brokers that have your requirements will know where to look, and who to look at, to get you the best deals.

Home Insurance Policy Costs and Payment

Even though you do not want to base your choice of home insurance policy on cost alone – it should be a consideration. You want to make sure that the cost of the policy is competitive and not too cheap. Cheaper-looking policies can initially attract you; however, when you start looking at the limitations and finer details, you often realize that you never get the coverage you expect or need.

Always make sure you break down the cost of any policies you are looking at. See what you are paying for and see what coverage you get for your premium. Also, factor in how you can pay for your home insurance policy.

You may want (or need) to pay for a policy over a period of several months. If flexibility is important to you in regard to payment, always look for policies that can offer you the payment methods you need.

Also Read This: Insurance Software Development Pros and Cons

Reputation and Recommendations for Home Insurance Policy

It is always nice to know that the insurance provider or service you want to use is highly recommended and that it comes with a positive reputation. When you find a provider that has a positive reputation it can give you that added security and peace of mind.

Looking at online reviews and seeing what other customers have said is important, as this will play a large role in the decision you make. Also, taking time to ask family, friends and work colleagues who they use and why may be beneficial.

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1-150x150.png)