Table of Contents

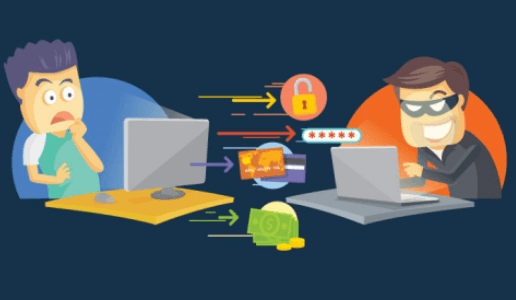

Identity theft has risen exponentially as a result of online scamming. Fortunately, trustworthy businesses have stepped forward to provide identity theft protection services. Signing up puts you in a better position to prevent would-be criminals from acquiring identifying data such as credit card info, banking details, login info of bobcasino.com, and much more.

Breaking Down Identity Theft Protection

Identity theft protection is a solution that provides different services aimed to better safeguard individuals from those wanting to benefit from their identity theft. The basic protection services consist of:

- Identity monitoring

- Identity recovery

- Credit monitoring

- Identity theft insurance

Understanding Identity Monitoring

Identity monitoring services may automatically search the web and online databases for personal details. If this information is discovered someplace it should not be, the service provider can determine whether it has been misused or is part of a known data breach.

Identity monitoring, unlike the other services, is preventive since nothing has happened to jeopardize someone’s identity yet. When possible breaches are discovered, the services give a list of remedies to the problem.

Assume your email was compromised as part of a breach. In this instance, an email and password may provide the criminal with access to your credit cards and other personally identifiable information. When a violation is identified, you may instantly reset your account password or deactivate the account completely to prevent thieves from using it for malicious purposes.

Understanding Identity Recovery

When something bad happens and it’s time to fix it, a customer might turn to identity recovery services for assistance. These service providers may help with credit report freezing, drafting letters to creditors claiming theft, and contacting law police as needed.

Victims can regain their identities without opting for a third party helping them with this issue. Nevertheless, this process would likely take a lot longer. At the absolute least, victims should look into the FTC’s free recovery center service.

Understanding Credit Monitoring

Individuals may rapidly examine their credit scores and credit reports utilizing numerous web methods, both free and paid, across a credit monitoring service. Credit monitoring systems, which are designed to identify possible identity theft in real-time, provide notifications anytime changes are identified. Consumers may immediately assess if the alterations are appropriate—or a symptom of identity theft—with this data in hand.

Amongst transactions that a credit monitoring service can identify are:

- New account registration

- Unauthorized transactions on several accounts

- Changes in addresses

- Overdue payments

- Closed accounts

- Other malicious or suspicious activities

Also Read This: 4 Things Your Ecommerce Business Must Be Aware Of

Understanding Identity Theft Insurance

Identity theft insurance is a solution that covers the costs of identity theft. By paying a monthly or annual charge, a subscriber will be reimbursed for any money spent on regaining financial identities and restoring credit records.

Identity theft coverage is included in most homeowners’ and renters’ insurance plans. Furthermore, most policies include deductibles to consider; these expenses must be compensated before the identity theft insurance kicks in. Policies encompass a wide range of subjects such as:

- Credit report costs

- Lost wages

- Document mailing

- Phone calls

- Notary fees

- Legal fees

- Credit monitoring services

Why Identity Theft Services Are Essential for Companies

Identity theft may be classified into eight forms. There’s government papers or benefits fraud, which typically consists of someone getting a hold of your social security number and utilizing it for different purposes, mortgage or lease fraud, child identity theft, as well as other means of data theft. Utility fraud, financial fraud, work or tax-related fraud, and healthcare identity theft are all possibilities.

Consumers should first use free of charge or affordable identity theft services available on the market before considering the expensive choices. Regardless, you should constantly be aware of what’s going on with your personal data and be on the lookout for any unusual changes.

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1-150x150.png)

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 9 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1.png)