Table of Contents

In today’s world where finances shape much of what we do understanding money becomes essential. Learning about finance gives you the power to make smart choices as you navigate your future. Z-lib is a powerful resource for financial literacy at every level—providing access to valuable insights on managing, investing, and growing money effectively. This knowledge isn’t just for professionals; anyone looking to secure their financial future can benefit greatly from reading about finance and applying these principles in their everyday life.

The Power of Financial Knowledge in an Uncertain World

Finance is no longer an option; it’s a must-have skill for anyone looking to grow in 2024. Financial literacy opens doors to better choices by showing how money works and how you can make it work for you. When you take time to understand finance you see its effects on everything around you—from your shopping choices to larger decisions like buying a home or starting a business. Knowing where to look for credible resources can set you up for success. A well-informed approach doesn’t just protect your wealth but also keeps you grounded in uncertain times, allowing you to stay calm and prepared.

Finances are more than numbers; they’re your future. Whether you’re investing in stocks, saving for retirement, or trying to start a business learning the right approach builds your confidence. You’ll feel empowered to make decisions that are best for you. Instead of relying on financial advisors alone, you gain the ability to evaluate choices independently. This doesn’t replace professional help, but it allows you to interact more knowledgeably with advisors or financial tools, enhancing your overall financial control.

How Financial Literacy Can Enhance Daily Life

Finance isn’t just for the wealthy or for experts; it’s for anyone wanting control over their money. Reading up on finance teaches you to manage your income, expenses, and future goals in a way that aligns with your lifestyle. The value of financial literacy is its ability to meet you where you are and provide a roadmap to where you want to go. For example, understanding personal finance can help you avoid common traps like unnecessary loans or high-interest credit cards that can hinder your future plans.

In addition to the practical benefits of learning finance, there is an emotional strength it brings. With financial knowledge you begin to feel less anxious about economic shifts or sudden expenses. You can respond to these situations with more calm and less panic because you know how to approach them effectively. Let’s look at some specific areas that finance can positively impact in daily life:

- Debt Management: Learning strategies to manage or eliminate debt builds stability and frees up resources for other important goals.

- Savings Goals: Setting realistic targets helps you save for essentials like emergencies and leisure activities in a way that suits your income.

- Investment Options: Understanding different investments allows you to grow wealth through paths like stocks, bonds, or real estate.

- Spending Habits: Recognizing where your money goes helps you reduce unnecessary costs while focusing on what truly matters to you.

- Retirement Planning: Knowing how to prepare for the future ensures that your later years are more comfortable and less financially strained.

When you have these skills under your belt, you’re ready for anything.

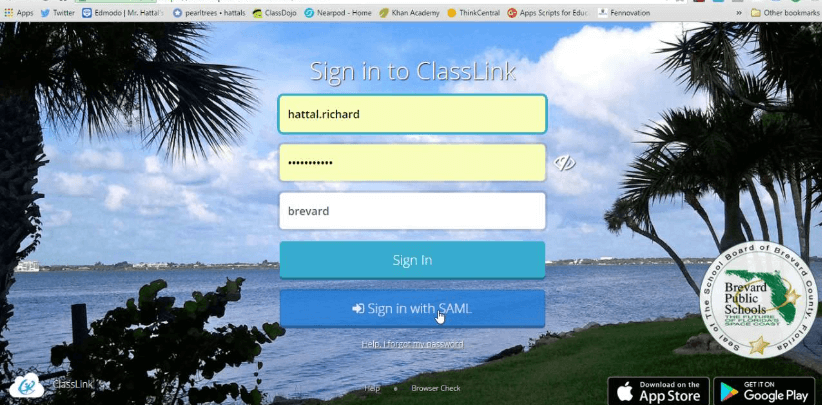

Staying Ahead with Resources Like ZLib

In the age of digital information, z library provides invaluable materials that make learning finance straightforward and affordable. With access to a vast selection of books, guides, and journals, you can dive into topics as specific as stock analysis or as broad as economic principles. What makes platforms like this effective is that they’re convenient and accessible, breaking down the barriers that often keep people from valuable learning. You don’t have to spend heavily or enroll in expensive courses; the knowledge is right at your fingertips, waiting to be explored.

Financial literacy isn’t just about gaining a new skill; it’s about creating a lifestyle that prioritizes your growth and security. As the world moves quickly, being financially prepared allows you to adapt with ease. You’ll have tools for navigating job changes, economic challenges, or even global shifts, providing resilience in any circumstance. This confidence not only aids in the short term but also lays the foundation for a lifetime of smart choices and informed actions.

Also Read: Jason Boptta Art

Transforming Your Future Through Financial Knowledge

Reading up on finance is your first step toward a stable and promising future. It empowers you to make wise decisions and gives you an edge in situations where others might hesitate. As you grow in financial literacy, you’ll find yourself achieving goals faster and with less stress. There’s a power in knowing that your future is in capable hands—your own.