Table of Contents

In today’s market, it is important for businesses to be able to offer their customers the choice to pay for goods & services with their preferred method of payment. With the ever-growing popularity of virtual reality (VR), there has been a growing demand for businesses that can offer payments in this new medium. One company that has decided to take advantage of this opportunity is Vive Financial. Vive Financial is a subsidiary of HTC and offers customers the ability to pay for goods and services with their VR headsets. This includes not only products from HTC and its partners but also third-party products.

Vive Financial recently opened up its first store entitled “The Box.” The Box is an experiential store that uses VR technology to allow customers to purchase items such as clothes, accessories, and food. The Box also offers customers the opportunity to try out different VR games before they buy them.

What is Vive Financial?

Vive Financial is a point-of-sale financing company offering lease-to-own and installment loan services for individuals with less-than-perfect credit. It partners with various retailers to provide flexible financing options, especially for essential products such as furniture, mattresses, electronics, and tires. Vive Financial is not affiliated with HTC or VR technology.

Vive Financial is a digital financial platform designed to make it easier for people to access the products they need and manage their finances.

By leveraging technology and data, Vive Financial helps users find the best rate on loans, investments, credit cards, and other financial products.

With its intuitive user interface, Vive Financial provides customers with an easy way to compare and customize products to fit their individual needs. Vive Financial also offers guidance and advice, helping customers make the best financial decisions for their particular circumstances.

In addition, users can monitor their finances with real-time data and notifications that help them stay on top of their finances

Benefits of using Vive Financial

Virtual reality is the latest technology that is slowly gaining popularity. Some people use it to escape the real world, and others use it to experience different things that they would not be able to do in the real world. However, one of the most popular uses of virtual reality is for shopping.

Vive Financial, a company that specializes in virtual reality shopping, has made it possible for customers to use this technology to buy items from stores that don’t have physical branches.

Here are some of the benefits of using Vive financial:

- Customers can shop from anywhere in the world.

- There is no need to leave your home or office and go to a store.

- You can see how the clothes will look on you before you buy them.

- You can try on different sizes before you decide which one to buy.

Vive Financial’s reach: How widespread is the platform?

Vive Financial, a digital financial platform, is expanding its reach to stores across the United States. The company has partnered with over 1,000 stores and continues to grow its partnership base. This includes retailers such as Macy’s, Sears, JCPenney, Target, and Walmart.

The company offers a variety of features that make it unique compared to other digital financial platforms. Vive Financial provides users with a budget planner and an account summary where they can see their spending history and progress towards their goals. The app also offers 24/7 customer support.

Vive Financial has seen success in growing its user base since it was launched in 2017. The company scheme to continue expanding its reach by partnering with more stores and offering additional features that will make the platform more valuable for users.

How Vive Financial works

Vive financial is a digital payments platform that allows customers to make purchases at participating stores. Customers can use Vive financial to pay for goods and services with their phones.

Vive financial has partnerships with many stores, including Walmart, Target, Kohl’s, Macy’s, Sears, and JCPenney. Customers can use vive financial to pay for their groceries, clothes, and other items in these stores.

The app also has a loyalty program called Club VIVE. Club VIVE members earn points when they shop at participating stores and then can use those points to purchase rewards such as gift cards or discounts on future purchases.

The Future of Vive Financial: What’s next for this innovative financial technology?

The future of Vive Financial is looking bright. This innovative financial technology is being used by a number of stores, and there are plans to expand its reach even further. The future of Vive financial looks to be very exciting, and it is sure to revolutionize the way people manage their finances.

One of the things that make Vive financial so great is that it is easy to use. Plus, it’s very user-friendly and convenient, which makes managing your money much easier.

As far as store usage goes, Vive financial is already in use by a number of different stores. This includes big-name chains like Walmart and Target as well as smaller stores like farmers’ markets and convenience stores.

Features for Selected stores that use Vive Financial

Vive Financial partners with a wide range of retailers across the U.S. The program is typically used in-store or through affiliated online retailers offering lease-purchase agreements or installment loan financing. Common retail categories include furniture, mattresses, appliances, tires, and hearing aids. Below is a list of known stores that use Vive Financial.

- Vive Financial is a payment processing solution that has been adopted by a number of popular stores.

- These stores include Amazon, Walmart, Starbucks, and Target, among others.

- Vive Financial is designed to make it easy for businesses to process payments and offers various features that can make it an attractive option.

- Some of these features include the ability to accept payments from both Visa and Mastercard and a variety of other options that can be customized to meet the needs of each individual store.

- Overall, Vive Financial is an effective solution that can help businesses take advantage of the opportunities that come with being able to accept payments online and in-store.

Informative Table: Stores That Accept Vive Financial

| Store Name | Category | Online / In-store | Financing Type |

|---|---|---|---|

| Big Sandy Superstore | Furniture & Appliances | Both | Installment Loans |

| American Freight | Furniture & Appliances | In-store | Lease-to-Own |

| Conn’s HomePlus | Electronics, Furniture | Both | Lease-to-Own / Loans |

| Acima Marketplace | Multiple Categories | Online | Lease-purchase |

| Beltone Hearing Aids | Health | In-store | Healthcare Financing |

| Mattress Firm | Mattresses | In-store | Financing Available |

| Badcock Home Furniture | Furniture | In-store | Vive Credit / Others |

| Bob Mills Furniture | Home Furniture | In-store | Third-party Financing |

Note: Availability varies by location and approval is subject to creditworthiness.

Add Eligibility Requirements

To use Vive Financial, applicants typically need to be 18 years or older, have a valid government-issued ID, a verifiable income source, and a checking account. Approval is based on alternative credit data, making it accessible to users with fair or poor credit.

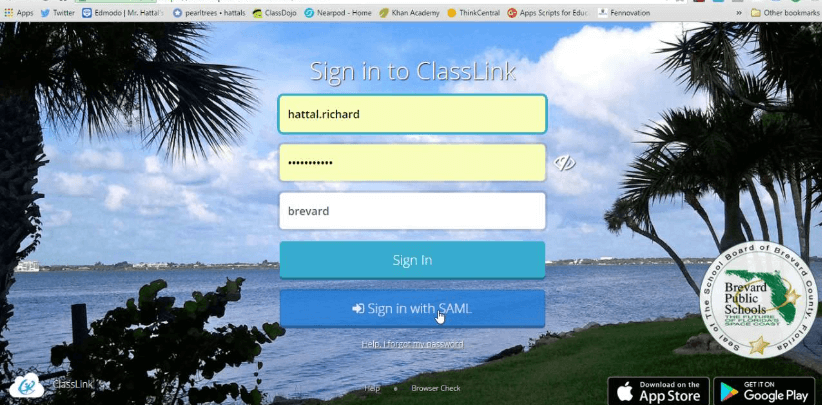

Strengthen User Experience Section

Vive Financial’s application process is straightforward and digital. Users apply either at the point of sale or online through partner portals. Once approved, customers can immediately make purchases or schedule deliveries. The program also reports to major credit bureaus, helping users build credit over time if payments are made responsibly.

Future of Vive Financial

In 2025 and beyond, Vive Financial is expected to expand its retailer partnerships and improve mobile integration for easier in-store application. With increased demand for subprime lending options, the platform is scaling to meet the financing needs of underserved credit segments across retail verticals.

What users can do with Vive Financial:

Vive Financial provides a number of features that make it a powerful tool for users. These include the ability to manage and track finances, as well as the ability to manage bills and expenses. This makes Vive Financial a great choice for users who want to improve their financial management skills.

In addition, Vive Financial offers integration with a number of stores. This means that users can easily purchase items from various stores using the app. Additionally, Vive Financial can be used to pay bills and other expenses.

Overall, Vive Financial is a powerful financial management tool that is perfect for users of all levels of experience.

The user experience:

The user experience with Vive Financial is quite easy. Stores that have already signed up to use Vive Financial include Target, Home Depot, Walmart, and Lowe’s. These stores are all major players in their respective marketplaces, so their decision to adopt Vive Financial is sure to be influential in the overall market growth of the app.

Also Read This: How Late Is the Closest Grocery Store Open?

Conclusion: What are the benefits of using Vive Financial?

What stores use Vive financial is the basic question asked by the people, so in this blog, there is a brief guide for the answer to this question.

There are many benefits to using Vive Financial, which include the ability to use the app in stores that typically don’t accept debit or credit cards. So read all the above guides to get all information.

FAQs

What types of loans does Vive Financial offer?

Vive Financial offers personal loans and debt consolidation loans.

How much can I borrow from Vive Financial?

A: Vive Financial offers personal loans ranging from $2,500 to $35,000, and debt consolidation loans ranging from $2,500 to $50,000.

What are the interest rates on Vive Financial loans?

The interest rates on Vive Financial loans vary based on your creditworthiness and other factors, but typically range from 8% to 36%.