During the first quarter of 2022, Bitcoin differs has unfortunately not had a good performance since it has received severe blows with the events between the FED declarations and the War between Russia and Ukraine.

A not very favorable outlook for the rest of the year, but this is expected to evolve with upward trends since the most crucial moments are already underway.

By 2021 bitcoin reached unimaginable values to the point that it reached almost 60,000 dollars for each extracted unit, which caused many economists to change their position and make predictions where everything points to this leading digital currency getting 100,000 dollars.

Although this situation seems unreal, likely, it will only happen that the beginning of 2022 for cryptocurrencies has been fatal.

This year Bitcoin was ahead of its corrective phase since, with so many events, it has not been able to exponentiate its valuation.

Can a trend change occur?

With the stabilization of the Bitcoin financial market and the other CRYPTOCURRENCIES, they could possibly have a break, achieving a better perspective in the remainder of the year.

It would be quite a significant achievement for crypto investments to get out of the stagnation that it has and that has lasted more than the quarter. Still, to evaluate a possible change in trend, it is necessary to carry out elementary analyses.

Technical analysis is the one that would allow us to observe the most opportune moment to enter the market, either buy or sell cryptocurrencies, establishing the necessary strategies and tools that will enable this analysis to be objective and practical.

When achieving this phase, two aspects must be considered that directly influence the valuation of cryptocurrencies; these aspects are the availability of units to be extracted and the positions generated by government entities.

Suppose we want to evaluate a possible change in the trend in Bitcoin. In that case, it is necessary to know that this cryptocurrency is not the leader of digital currencies because it is the pioneer, nothing more; unlike Fiat currencies, this digital currency is produced through a network of computers.

If we observe the trajectory of Bitcoin, we realize that it has been taking on more characteristics than traditional currencies in terms of its use and management because, over time, more aspects satisfy the use of these digital resources.

The digitization of traditional platforms has allowed users to become familiar with electronic transactions, which means that in a supposed denial of the massive adoption of cryptocurrencies, many will be able to carry out digital transactions.

Although their volatility has harmed them, they always manage to get out of the water without having to issue more coins or inject capital; they alone complete their cycle and recover; that is where the profits are for everyone in proportion to their invested capital.

Financial forecast for 2022

Although Bitcoin prices have shown a significant drop compared to the values recorded during 2021, this first quarter showed that even in complex scenarios, it can have an encouraging attitude and achieve the rise that everyone expects.

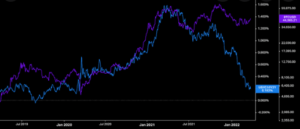

Economists assume that there is a continuous recovery; the analysis of the graphs and their trajectory shows that the price of Bitcoin has reached minimum historical values since the last six months of the year 2021.

Its closing value for the first quarter was below the initial deal with which it started in 2022; its initial value was around $46,000, and it closed the quarter between $45,000.

According to market analysts, the expectations that the value of Bitcoin will resume its upward trend is very likely for the second quarter of 2022 since the candles have shown that they are in a recovery phase, which undoubtedly indicates an upward trend.

One of the forecasts that have caused the most controversy is that when Bitcoin has downward trends, its recovery is usually to generate digital currency values higher than the last historical maximum value.

This generates excellent commotion among its users since it could collectively generate profits, triggering many investors’ invested capital.

This year has shown that a digital financial system does not sound so far-fetched for a country’s economy since cryptocurrencies, especially Bitcoin, have allowed nations to emerge afloat during crises that can significantly affect the stability of nations, as in the case of Russia and Ukraine.

Conclusion

The financial markets are volatile in nature. However, the cryptocurrency market is much riskier; it is also a matter of seeing what types of operations are convenient to analyze for what is coming in the second quarter of 2022.

Everything points to the rise; it only remains to wait for the natural behavior of the market and the action of cryptocurrencies in the face of new possible institutional measures.

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1-150x150.png)