Table of Contents

Digital lending was a response to the pain points customers experience with traditional lending, such as tedious loan processes and the requirement to have good credit history for access to bank loans (Infosys BPM, n.d.).

It was also a response to the digitization of personal finance, as digital lenders sought to fill the gaps where customers expressed a preference for digital services. For some, financial institutions had made borrowing too hard or simply inaccessible (Infosys BPM, n.d.).

Consumer Lending is Changing

Technological advancement has spurred on much of the change in consumer lending. The availability of data allows the lender to look deeper than the credit score when analyzing a customer’s creditworthiness, resulting in a more accurate risk assessment (Infosys BPM, n.d.).

Digital lenders can have access to employment history, education details, and spending habits that help them better understand if an applicant will be able to pay their debts (Srivastava, 2021). Access to this data also allows for a new way of looking at credit scores.

Furthermore, the introduction of AI, algorithms and machine learning enables digital lending apps to detect and eliminate fraud and upgrade and ease administrative tasks (Infosys BPM, n.d.).

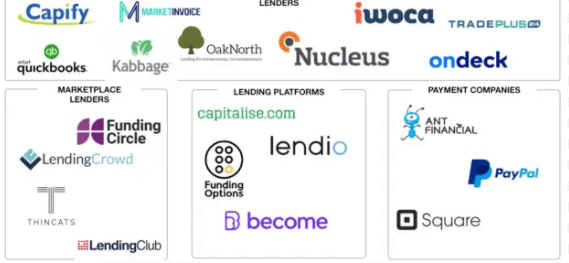

Another change is the introduction of non-banking institutions into the consumer lending space. Amazon offers loans to small businesses and Apple introduced a digital credit card (Srivastava, 2021).

Backed by technologies such as blockchain and AI, a greater number of peer-to-peer (P2P) lending organizations will continue to emerge, giving traditional financial institutions a run for their money (Srivastava, 2021).

Must Read: Credit Card Generator | Top10 credit card generators that work 2021

What is Open Banking?

Open banking is a banking practice that securely shares financial information, such as consumer banking transactions and other financial data, to third-party financial service providers (Estevez, 2020).

Sharing data is done through the use of application programming interfaces (APIs) and only with the consent of customers (The Balance, 2020). Open banking is the driver behind both innovation and competition in the financial industry (Cahill, n.d.).

Must Read:10 best results-oriented digital marketing companies in the USA

Why Does Consumer Lending Use Open Banking?

Consumer lending is becoming increasingly digital. Open banking allows companies to build a process that increases conversion rates and approval rates for creditworthy customers.

Open banking helps companies automatically acquire and analyse open banking data, meaning the number of clients that have a limited or no credit history can be instantly eliminated.

Furthermore, open banking helps increase the speed of loan application screening and approval. Finally, open banking reduces admin costs by reducing the number of manually entered data points and allows population risk-critical information.

Must Read:Top Apps That Deserve Awards (Updated Version)

Some Consumer Lending Companies You Should Know About

Lendable is a London-based lending platform that offers fast loans at fair rates. The company eliminates the need for bank loans by using peer-to-peer lending and allows qualified investors to invest in consumer loans found on the platform.

Lendable uses AISPs that allows customers to send information on their payment accounts to them and other service providers (Lendable, n.d.).

IPF Digital is a leading online provider of short and medium-term loans to customers in Finland, Estonia, Latvia, Lithuania, Poland, Spain, Mexico, and Australia. IPF Digital uses open banking to increase loan applicant approval.

The company has been using Nordigen’s engine to automate the analysis of bank statements and raw account data (Nordigen, n.d.). IPF Digital uses this information to make lending decisions.

Koyo is the UK’s first open banking powered lender and uses open banking technology to base lending decisions on real financial situations (Koyo, 2020).

Koyo is attempting to fix the problem that people without much credit history are unable to secure a loan. So, instead of just looking at a credit score, Koyo looks at transactions in a customer’s account.

What’s to Come?

To develop and grow, the consumer lending sector requires constant innovation – but to ensure safety and ethics, it also needs proper regulations.

The emergence of new digital credit products has prompted regulatory concerns regarding customer protection and limiting the risk associated with financial markets.

In Europe, malpractices in the consumer credit market have been exposed by raising concerns regarding the Consumer Credit Directive and emphasizing the need to review certain provisions of the directive, such as the credit-granting process (Vinod Kothari Consultants, 2021).

Going forward, the Directive should use future-proof and technology-neutral text that enables it to be relevant even with technological developments (Pecchini, 2021).

Reference:

Article prepared by Nordigen.com

Original article with links to sources (https://nordigen.com/en/blog/how-consumerlending-uses-open-banking/).

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1-150x150.png)

![1000 Girl Attitude Names for Truecaller ID | UPDATED [Included Boys Names] 9 1000 Attitude Names for Girls on Truecaller](https://edutechbuddy.com/wp-content/uploads/2025/05/ChatGPT-Image-May-21-2025-11_59_39-PM-1.png)